Financial Management - Relation Between Risk and Return

Risk and Return

What is investment risk?

Investment risk is exposure to the chance of earning less than expected.

Stand - Alone Risk: Standard Deviation

Stand - alone risk is the risk of each asset held by itself.

Portfolio Returns

It is weighted sum of returns. Portfolio’s std. dev tends to be less than non - portfolio case.

Correlation Coefficient

Population Covariance

For two stocks, variance is:

$!\begin{aligned}

Var(R_p) &= \sigma_p^2\\

&= \sigma^2 (w R_1 + (1 - w) R_2)\\

&= w^2 \sigma_1 ^2 + (1 - w)^2\sigma_2^2 + 2w(1-w)Cov(R_1, R_2)\\

\end{aligned}$!

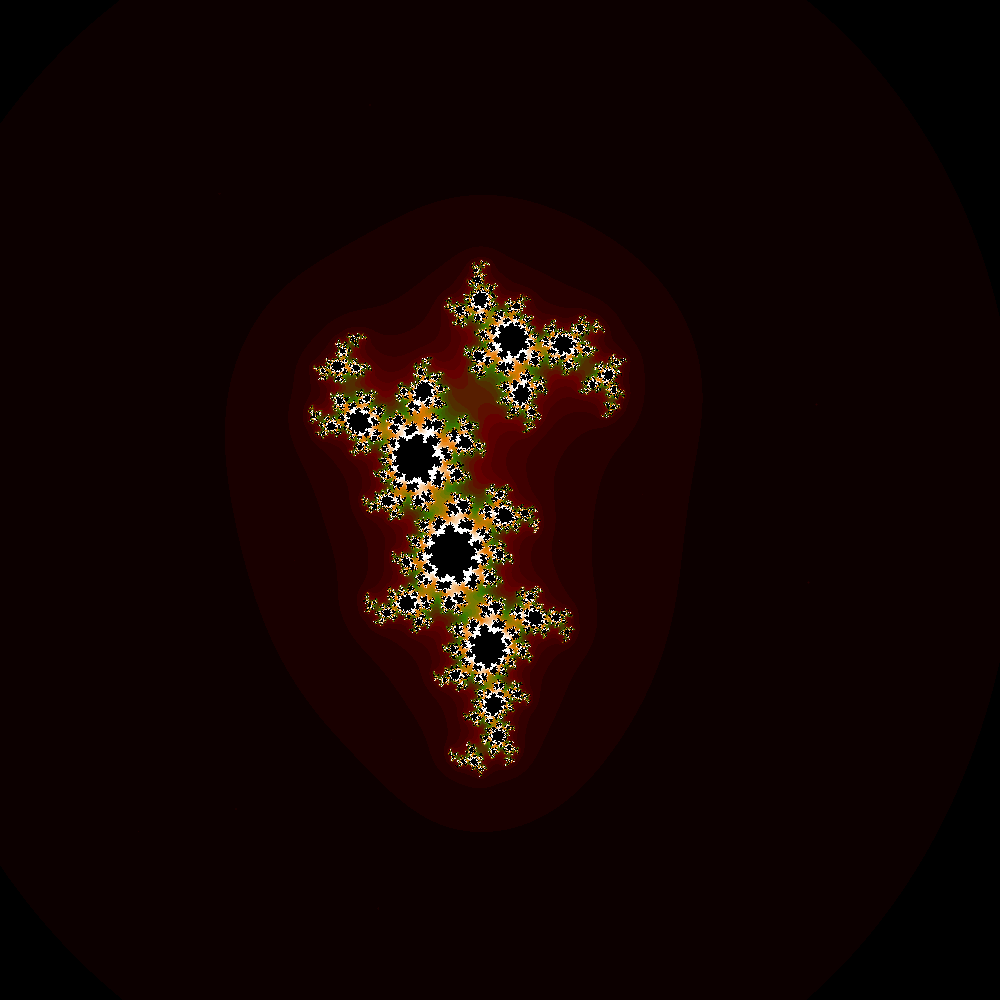

using this exact formula, consider two asset A, B with each volatility of 38.9%, 24.1% and mean return of 7.6%, 1.9%. The following plot is graph of weight of A from 0 to 1, X axis as mean return and Y axis stand alone risk (sdv)

This is the case where A and B has 0 correlation.

However, once I increase correlation to -0.5, the curve curves downward.

Infact, if A and B has -1 correlation, curve meets the X axis:

Thus, we see that if two assets move in different direction, we can create portfolio that has less risk for same return.

Systemic Risk:

Stand - alone risk = Market risk + Diversifiable Risk

Market Risk is that part of a security’s stand - alone risk that cannot be eliminated by diversification.

Market risk = undiversifiable risk = common risk = systematic Risk

Firm - specific risk that part of security’s stand - alone risk that can be eliminated by diversification.

Firm - specific risk = diversifiable risk = independent risk = idiosyncratic risk

Diversification :

- THe averaging out of independent risks in a large portfolio

You can get rid of firm - specific risk by making large portfolio, and therefore does not need to have risk premium for individual company. $$\rarr$$ Noone will pay you that. Therefore hold only market risk, historically proven that higher the market risk, greater the return.

Market Risk.

How do we measure the market risk?

The Capital Asset Pricing Model

The CAPM says:

$!

RP_i = E(R_i) - R_f = RP_M \cdot \beta_i

$!

where:

$$RP_M$$ : market risk premium = $$E(R_M) - R_f $$

$$\beta_i$$ : market beta of stock i.

What is $$\beta_i$$? It is Sensitivity of a stock’s return to the market’s fluctuation.

$!

\beta_i = \frac{Cov(R_i, R_M)}{Var(R_M)} = \frac{\rho \sigma_i \sigma_M}{\sigma_M^2} = \frac{\rho \sigma_i}{\sigma_M}

$!

roughly says that when market return moves by 1%, the stock return moves by beta%.

How to estimate $$R_f$$?

THe return required as a compensation for the expected loss purchasing power = the expected rate of inflation.

How about $$RP_M$$?

Maybe use historical data? There isn’t exactly guideline…